Carbon Credit Brokerage Business

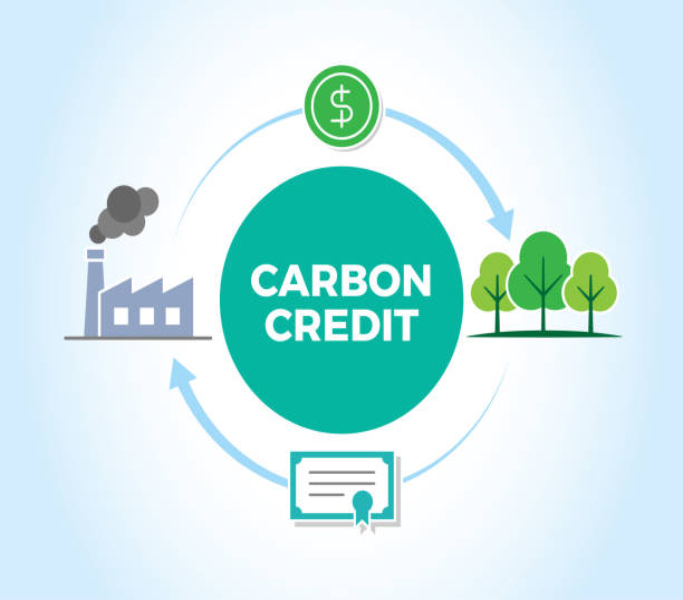

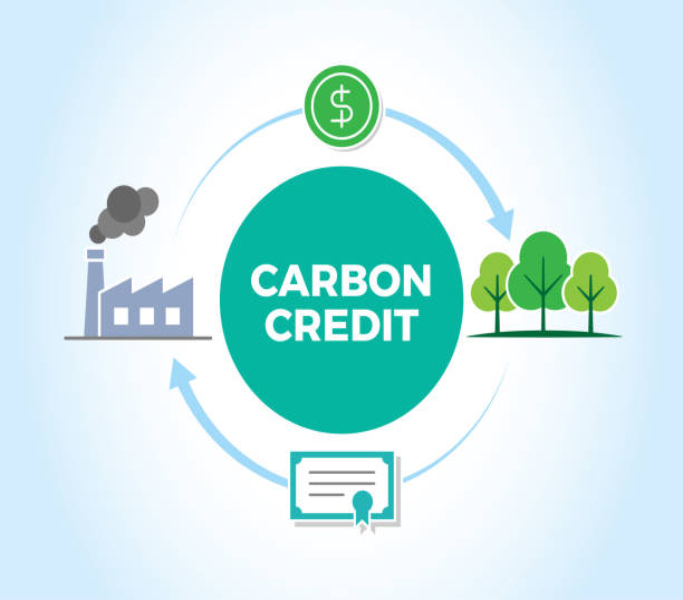

These credits represent a reduction in greenhouse gas emissions and are used by companies to meet regulatory or voluntary carbon reduction goals.

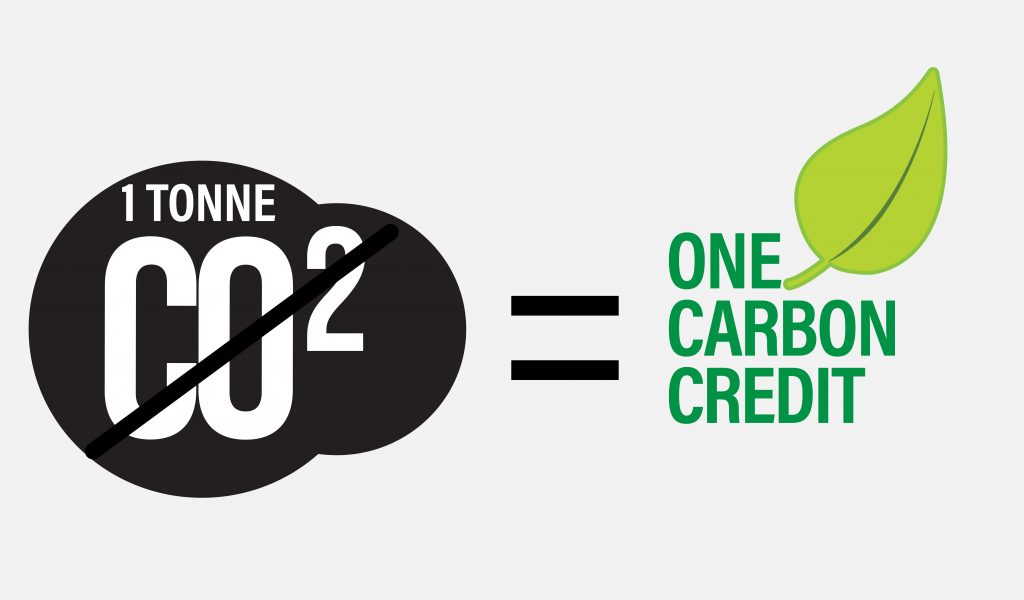

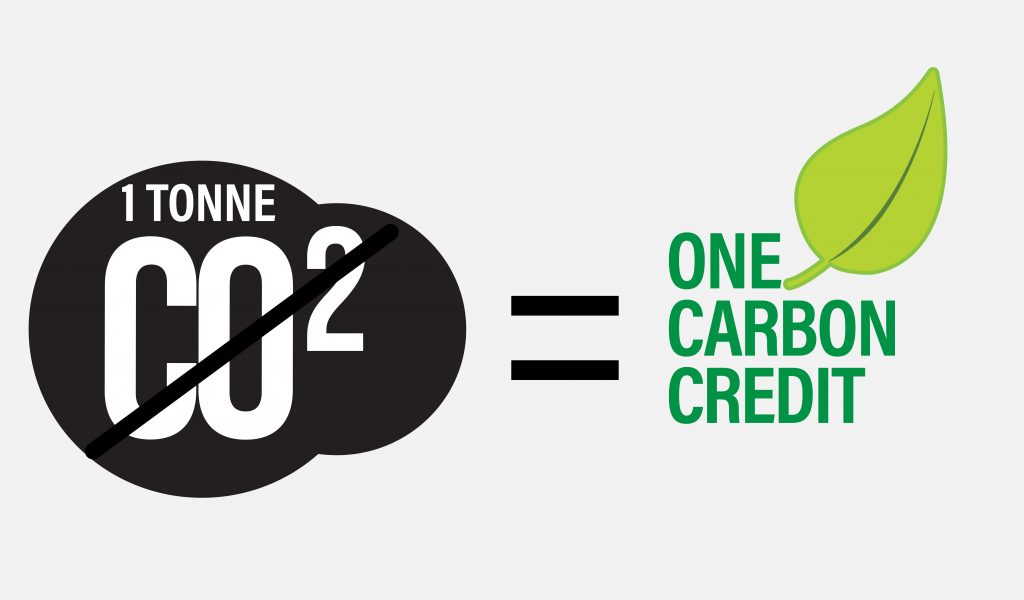

Overview: Voluntary carbon markets (VCMs) in the USA allow companies, NGOs, governments, and other entities to buy and sell carbon credits voluntarily. These credits represent one tone of carbon reduced or removed from the atmosphere.

Regulation and Standards: The U.S. Department of the Treasury has released principles for responsible participation in VCMs to ensure high integrity and transparency. Standards such as the Climate Action Reserve, Voluntary Carbon Standard, and American Carbon Registry are commonly used3.

Market Dynamics: VCMs in the USA are growing, and various sectors, including agriculture, forestry, and energy, are showing increasing interest.

Overview: The global VCM is a non-centralized, fragmented market where private buyers and sellers exchange carbon credits. These credits are generated by diverse projects globally and certified by various independent organizations.

Challenges: The market faces challenges such as ensuring the credibility of carbon offset credits and maintaining buyer confidence.

In the voluntary carbon credit market, credits are typically generated through projects that reduce, avoid, or remove greenhouse gas emissions. These projects can include reforestation, renewable energy installations, energy efficiency improvements, and more. Each credit usually represents one metric ton (MT) of carbon dioxide (CO2) or its equivalent in other greenhouse gases that have been reduced or removed from the atmosphere.

1. **Project Development**: A project is designed to reduce or remove emissions. This could be anything from planting trees to installing solar panels.

2. **Validation**: The project is assessed by an independent third party to ensure it meets specific standards and criteria. This often involves verifying the project's potential to reduce emissions.

3. **Monitoring and Verification**: Once the project is operational, an independent auditor monitors and verifies its actual emissions reductions. This ensures that the project is delivering the promised environmental benefits.

4. **Issuance of Credits**: Carbon credits are issued after successful verification. These credits can then be sold or traded in the voluntary market.

5. **Retirement of Credits**: When a credit is used to offset emissions, it is "retired" to ensure it cannot be used again.

The voluntary carbon market is diverse, with various standards and methodologies, such as the Verified Carbon Standard (VCS) and the Gold Standard, which provide frameworks for project validation and credit issuance.